Photomas rất cần thiết cho sản xuất chất bán dẫn

Các nhà sản xuất vật liệu bán dẫn đang bắt tay vào đầu tư để tăng sản lượng. Toppan Printing sẽ đầu tư khoảng 20 tỷ yên thông qua công ty con vào năm tài chính 2023 để tăng cường các cơ sở sản xuất tấm thủy tinh được sử dụng trong sản xuất chất bán dẫn. Tập đoàn Hóa chất Mitsubishi đã thiết lập các cơ sở sản xuất axit sulfuric có độ tinh khiết cao ở Đài Loan, được sử dụng để làm sạch chất bán dẫn. Các công ty vật liệu sẽ tiếp tục đầu tư mạnh mẽ để đón đầu nhu cầu mạnh mẽ trong trung và dài hạn.

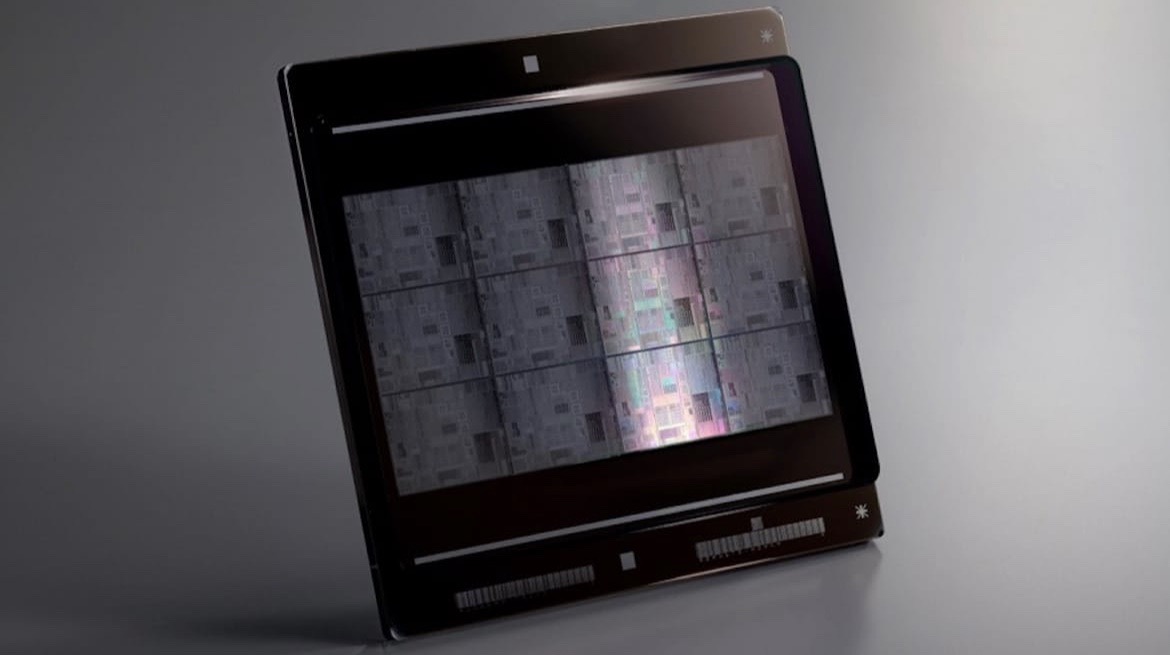

Toppan Photomask, một công ty con của Toppan Co., Ltd. (Minato, Tokyo) xử lý photomask, là một tấm thủy tinh có hình mạch nhỏ trên bề mặt của nó. Nó đóng vai trò in mạch lên tấm silicon. Nó cung cấp cho các nhà sản xuất chất bán dẫn lớn ở Hoa Kỳ và Đài Loan.

Toppan Photomask sẽ củng cố và đổi mới cơ sở sản xuất tại các nhà máy của mình ở thành phố Niiza, tỉnh Saitama và Đài Loan. Đối với chất bán dẫn logic, chiều rộng đường mạch là 5 đến 10 nanomet (nano là một phần tỷ) và đối với DRAM, dây chuyền sản xuất các sản phẩm tiên tiến có chiều rộng 10 nanomet sẽ được tăng lên. Năng lực sản xuất photomas cho các chất bán dẫn có kích thước nhỏ hơn 40 nanomet sẽ được tăng lên khoảng 20% so với mức tài khóa 2020.

Khoảng 10 tỷ yên đã được đầu tư vào năm tài chính 2021. Công ty cũng sẽ tăng các dây chuyền cho thiết bị tiếp xúc với tia cực tím EUV (cực tím), thiết bị cần thiết để sản xuất chất bán dẫn tiên tiến. Theo công ty, nhu cầu về chất bán dẫn logic, ... dự kiến sẽ tăng trong trung và dài hạn, mặc dù sẽ không có gì ngạc nhiên nếu có những động thái để loại bỏ lượng dư thừa trong ngắn hạn.

Trong bối cảnh tốc độ truyền thông tăng và khối lượng dữ liệu tăng, cung và cầu về chất bán dẫn đã trở nên eo hẹp trên khắp thế giới. Theo thống kê thị trường bán dẫn thế giới, thị trường bán dẫn toàn cầu năm 2021 đạt hơn 70 nghìn tỷ yên, tăng 26% so với năm 2020.

Ngành công nghiệp bán dẫn đã trải qua một `` chu kỳ silicon '' lặp đi lặp lại sự bùng nổ và phá vỡ trong chu kỳ từ ba đến bốn năm. Thị trường toàn cầu năm 2019 tăng trưởng chậm lại 12% so với năm 2018, nhưng đã quay trở lại quỹ đạo tăng trưởng vào năm 2020 với mức tăng 7% so với năm 2019. Các nhà sản xuất vật liệu, vốn đã hạn chế đầu tư do lo ngại suy thoái, đã chuyển sang đầu tư mạnh mẽ vì sản xuất của họ không thể theo kịp với sự gia tăng nhanh chóng của nhu cầu vào năm 2021.

Dai Nippon Printing Co., Ltd. (DNP), công ty xử lý photomas, sẽ đầu tư gần 10 tỷ yên vào năm tài chính 2023 để tăng dây chuyền sản xuất tại các nhà máy ở Nhật Bản, Trung Quốc và Đài Loan. ADEKA, một nhà sản xuất hóa chất quy mô trung bình, sẽ xây dựng một tòa nhà mới tại nhà máy ở Hàn Quốc để xử lý các vật liệu tiên tiến được sử dụng trong chất bán dẫn, "vật liệu điện môi cao", và tăng gấp đôi công suất sản xuất.

Vào năm 2022, nhiều nhà sản xuất vật liệu đã bắt đầu tăng sản lượng toàn bộ. Tập đoàn Hóa chất Mitsubishi đã đầu tư hàng tỷ yên vào một nhà máy ở Đài Loan vào mùa xuân năm nay để tăng năng lực sản xuất axit sulfuric có độ tinh khiết cao lên 1,5 lần. Tokuyama đang vận hành một nhà máy mới ở Đài Loan sản xuất cồn có độ tinh khiết cao, được sử dụng làm chất lỏng tẩy rửa trong quy trình sản xuất chất bán dẫn.

Hiện tại, doanh số bán điện thoại thông minh và máy tính cá nhân đang chậm lại trong bối cảnh lạm phát và nhu cầu bán dẫn đang bước vào giai đoạn điều chỉnh. Vào cuối tháng 7, Gartner đã hạ dự báo thị trường bán dẫn vào năm 2022 xuống còn 7,4% (trước đó là 13,6%).

Mặt khác, nguồn cung và nhu cầu về chất bán dẫn cho ô tô và trung tâm dữ liệu vẫn tiếp diễn. Trong trung và dài hạn, có nhiều khả năng là các yêu cầu đối với chất bán dẫn, cũng được sử dụng trong chuyển đổi kỹ thuật số (DX), sẽ tăng lên.

Hiệp hội thiết bị bán dẫn Nhật Bản (SEAJ) dự kiến rằng doanh thu của thiết bị sản xuất chất bán dẫn do Nhật Bản sản xuất trong năm tài chính 2022 sẽ tăng 17% từ năm tài chính 2021 lên 4.028,3 tỷ yên. Nó đã được điều chỉnh tăng 478,3 tỷ yên so với dự báo vào tháng 1 năm nay. Đầu tư tích cực tiếp tục ở phần thượng nguồn của chuỗi cung ứng (mạng lưới cung ứng).

Trong và ngoài nước, ngày càng có phong trào thu hút các nhà máy sản xuất chất bán dẫn. Tại Hoa Kỳ, một dự luật đã được ban hành để thúc đẩy chiến lược ngành công nghiệp bán dẫn với các khoản trợ cấp. Tại Nhật Bản, Công ty TNHH Sản xuất Chất bán dẫn Đài Loan (TSMC), Tập đoàn Sony và Denso đã phê duyệt kế hoạch xây dựng một nhà máy bán dẫn ở tỉnh Kumamoto.

Cạnh tranh giữa các quốc gia là động lực chính cho các nhà máy mới, và làn gió thuận lợi cũng đang đến với các nhà sản xuất vật liệu. Các nhà sản xuất Nhật Bản có thế mạnh về vật liệu, và Toppan Photomask được cho là có thị phần hàng đầu thế giới trong thị trường sản xuất thuê ngoài. Mỗi công ty được yêu cầu phải có sự bền bỉ để duy trì khả năng cạnh tranh bằng cách đầu tư vào việc tăng cường sản xuất để đáp ứng với những thay đổi của điều kiện thị trường và mạng lưới cung ứng.