Đối tác Hydro sạch đang tìm kiếm các Cơ quan quản lý khu vực và quốc gia từ EU-27 và các quốc gia liên kết với Horizon Europe để phát triển hợp tác trong các lĩnh vực chính có liên quan để phát triển hydro.

Sáng kiến này là sáng kiến mới nhất trong một loạt các hợp tác giữa Đối tác hydro sạch và các cơ quan chức năng ở các cấp lãnh thổ khác nhau và thể hiện cơ hội hợp tác để thúc đẩy hydro ở các khu vực cụ thể. Khoảng 10 Cơ quan quản lý sẽ được lựa chọn dựa trên thông tin được cung cấp trong các biểu hiện quan tâm của họ.

Để theo đuổi sáng kiến này, Clean Hydrogen Partnership đã ký hợp đồng với một nhóm bao gồm CIRCE, White Research và Q-Plan International.

Các cơ quan quản lý thành công sẽ nhận được hỗ trợ kỹ thuật có mục tiêu để phát triển sức mạnh tổng hợp với Quan hệ đối tác hydro sạch. Nhờ sự hỗ trợ, các cơ quan quản lý có thể mong đợi tăng cường hợp tác với JU trong các lĩnh vực chính liên quan đến R&I và khai thác kết quả, bao gồm: Hỗ trợ kỹ thuật, Quản lý tri thức và Tài trợ và Tài chính, dẫn đến việc ký kết các Thỏa thuận hợp tác.

Các thỏa thuận này sẽ phản ánh việc đánh giá các công cụ hiệp lực khác nhau trong tầm tay, cùng với các cam kết cụ thể liên quan đến việc thực hiện hiệp lực và sẽ được cấu trúc khác nhau cho mỗi cơ quan, cho phép các hiệp lực được thực hiện được điều chỉnh theo nhu cầu và bối cảnh của mỗi cơ quan. Thời gian nộp hồ sơ trước ngày 7/<>.

Tin tức về EoI trùng hợp với hội thảo trên web về 'Trung tâm và Thung lũng Hydro' do Đối tác Hydro sạch, Đối tác Hydro Châu Phi và Liên minh Hydro Xanh tổ chức, trước Đại hội Hydro Thế giới tại Rotterdam vào tháng 9 (13-<>).

Thung lũng Hydro là một khu vực địa lý xác định nơi hydro phục vụ nhiều hơn một lĩnh vực cuối cùng hoặc ứng dụng trong di động, công nghiệp và năng lượng. Chúng thường bao gồm khoản đầu tư hàng triệu euro và bao gồm tất cả các bước cần thiết trong chuỗi giá trị hydro, từ sản xuất (và thậm chí thường là sản xuất điện tái tạo chuyên dụng) đến lưu trữ tiếp theo và vận chuyển & phân phối cho các bên bao tiêu khác nhau.

Tiến sĩ Matthiys Soede, Cán bộ chính sách của Ủy ban châu Âu và Giám đốc Đổi mới sứ mệnh, cho biết hydro sẽ là một khối xây dựng rất quan trọng trong quá trình chuyển đổi năng lượng. Quan hệ đối tác của nó được dẫn dắt bởi Úc, Chile, EU, Mỹ và Anh và bao gồm 21 quốc gia hỗ trợ.

"Tại Mission Innovation, chúng tôi muốn làm cho hydro có giá cả phải chăng và dễ tiếp cận cho tất cả mọi người - và để làm cho nó có thể, chúng tôi nên làm cho hydro xanh có chi phí cạnh tranh. Mục tiêu của chúng tôi, và đó là một mục tiêu đầy khát vọng, là có 2 đô la mỗi kg vào năm 2030. Nó không chỉ sản xuất hydro, bạn còn phải lưu trữ và phân phối nó như một chi phí".

Ông cho biết họ đã xác định được 80 thung lũng hydro và nhắm mục tiêu 20 thung lũng khác vào cuối năm nay và đặt mục tiêu đưa tất cả chúng vào hoạt động vào năm 2030. Tuy nhiên, trở ngại chính vẫn là FID, với ba phần tư vẫn chưa đạt được trạng thái FID.

Lily Backer, Giám đốc Tiếp thị tại Liên minh Hydro Xanh, cho biết hiện tại DOE đang xem xét các đơn đăng ký cho đợt tài trợ đầu tiên của các trung tâm hydro sạch, trước khi các trung tâm thành công - dự kiến từ sáu đến 10 - được công bố vào mùa thu.

Bà nói: "Chúng tôi hy vọng rằng các trung tâm này sẽ phản ánh sự đa dạng và tiềm năng sử dụng cuối cùng trên khắp Hoa Kỳ, và nhiều loại nguyên liệu khác nhau để tạo ra hydro tái tạo, chẳng hạn như điện tái tạo, hạt nhân, khí tự nhiên và CCUS."

Chuyển sang IRA, bà nói thêm, "Cách thức hoạt động của các khoản tín dụng này là bạn thực sự nhận được tín dụng ngày càng tăng với carbon thấp hơn, xanh hoặc hydro sạch. Vì vậy, điều này có nghĩa là khuyến khích các con đường khử cacbon và tạo sân chơi bình đẳng cho các công nghệ sạch. Tất cả chúng tôi đang chờ hướng dẫn bổ sung về cách chính xác bạn đủ điều kiện nhận các khoản tín dụng này - vì vậy rất nhiều người đang ở trong 'mô hình giữ' cho đến khi chúng tôi nhận được hướng dẫn này.

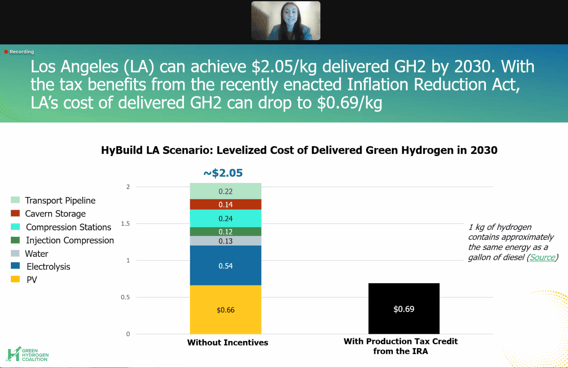

Nhấn mạnh tiềm năng của Los Angeles, nơi đang nhắm mục tiêu 100% điện tái tạo vào năm 2035, bà cho biết "chắc chắn có thể" sản xuất hydro xanh có tay nghề cao, chi phí thấp ở thành phố bờ biển phía tây và tạo ra "hàng chục nghìn" việc làm.

Khi bao thanh toán các khoản tín dụng thuế IRA, bà cho biết phân tích HyBuild của họ cho biết nó có thể đạt 2,05 đô la mỗi kg vào năm 2030 và cuối cùng là "dưới 70 xu mỗi kg được giao". Công suất năng lượng mặt trời sẽ được sản xuất bên ngoài thành phố, nơi có nhiều không gian hơn.

Bà nói thêm: "Chúng tôi cũng nhận thấy rằng cách rẻ nhất để cung cấp hydro xanh sẽ là bằng đường ống dẫn hydro 100%. Nhu cầu về hydro xanh trong lưu vực LA là đáng kể... Chúng tôi đã xác định được hơn 5 triệu tấn nhu cầu hydro xanh đủ điều kiện mỗi năm vào năm 2030".

Phương pháp đã được chứng minh thương mại để lưu trữ hydro ở Mỹ là thông qua các hang động muối địa chất, Backer nói.

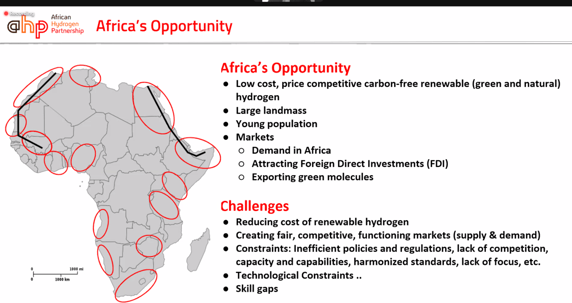

Bamidele Adebisi, Giáo sư Hệ thống Cơ sở hạ tầng Thông minh tại Đại học Manchester Metropolitan, đã phác thảo tiềm năng hydro của châu Phi thông qua công việc của Đối tác hydro. Với khoảng 70% công nghệ hydro hiện tại được sản xuất bên ngoài lục địa, ông cho biết đây là một mối quan tâm lớn cần được giải quyết, cũng như các vấn đề được ghi nhận rõ ràng xung quanh quy định, chính sách và khoảng cách kỹ năng.

"Đó thực sự là về việc mở rộng quy mô và cân bằng cung và cầu hydro xanh, luôn có sự thúc đẩy và kéo này. Ở Mỹ và châu Âu, bạn có trợ cấp nhưng điều này không thực sự có sẵn - lãi suất rất cao - vì vậy chúng tôi thực sự cần tìm thứ gì đó phù hợp với châu Phi, ở châu Phi.

Một slide chuyển đổi cho thấy mục tiêu ngắn hạn của châu Phi sẽ là phát triển thị trường nội địa, tiếp theo là thu hút FDI trong trung hạn và xuất khẩu các phân tử xanh trong dài hạn. Các slide khác cho thấy sự phát triển giữa các ứng cử viên hàng đầu như Namibia, Morocco, Ai Cập, Mauritania và Nam Phi, nhưng nhiều quốc gia khác cần phải tham gia trên khắp lục địa.

"Đó cũng là về tiếp cận năng lượng, vì 50% người dân châu Phi hoàn toàn không được tiếp cận với điện và công nghiệp hóa; làm thế nào chúng ta có thể tận dụng các thung lũng hydro để công nghiệp hóa châu Phi, tạo việc làm và cơ hội?"