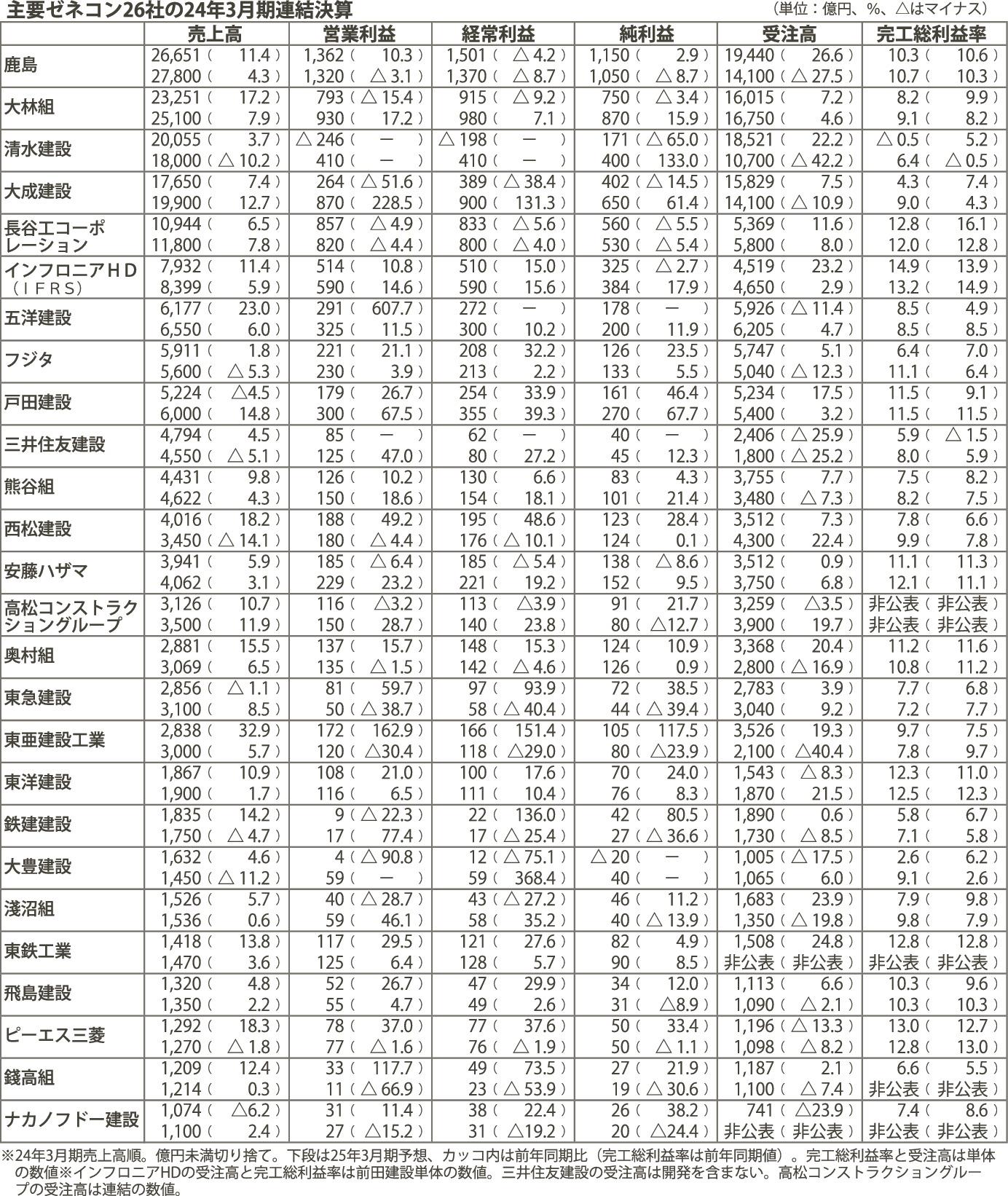

The financial results of 26 major general contractors for the fiscal year ending March 2024 were released on the 15th. Consolidated revenue increased at 23 companies due to strong construction demand. Domestic construction/civil construction and overseas construction are both progressing smoothly. Operating profit, which represents the profit of the core business, fell at nine companies compared to the previous quarter due to factors such as salary increases and improved compensation to survive in the recruitment competition as well as DX-related investments to improve productivity. In the fiscal year ending March 2025, 12 companies are expected to increase revenue and operating profit. Thirteen companies decreased the number of orders received compared to the previous quarter. We aim to ensure profitability by accepting orders with a focus on profitability while understanding the construction system.

Consolidated revenue hit record highs for companies such as Kajima, Obayashi Corporation, Infronia Holdings (HD) and Pentayo Construction. Three companies with declining revenue are Toda Construction, Tokyu Construction and Nakanofudo Construction.

The operating profit of 17 companies exceeded the previous year's level. Companies that saw profits increase said that “margins have improved in the construction and civil engineering industry,” while others said that “price increases, strained equipment and negotiations with customers" are concerns (large general contractors).

Looking at the gross margin (gross profit) of completed construction alone, which shows the profitability of construction work, 10 companies, including Kajima, Haseko Corporation, Infronia HD, Toda Construction and Ando Hazama, reached double-digit percentages. “The impact of low-margin construction work will be largely resolved by the end of 2024,” Kumagai Gumi said. On the other hand, many companies are taking a cautious stance because they do not expect rapid improvement.

Unconsolidated orders, a leading indicator of business performance, increased from the previous quarter for 19 companies due to strong construction demand. While demand is growing both domestically and internationally, especially in the manufacturing industry, each company is very selective in accepting orders with a focus on profits. Of the 24 companies that have published order forecasts for the fiscal year ending March 2025, 13 expect a decline. One mid-sized general contractor said it would only take orders for projects that would allow it to close the facility eight times a week, given figures that take into account construction systems and overtime limits.

He says the key to profitability is relationships with equipment builders. Each company has a policy to ensure the safety of subcontractors before receiving orders. A second-level general contractor said: ``In addition to the lack of equipment contractors, labor costs will continue to increase. .'' Large air conditioning equipment construction companies say they have no intention of accepting cheap contracts and that it will be important going forward that they become “general contractors of choice” over time. and suitable construction price.

Invite partners to see the activities of Pacific Group Company Limited.

FanPage: https://www.facebook.com/Pacific-Group

YouTube: https://www.youtube.com/@PacificGroupCoLt