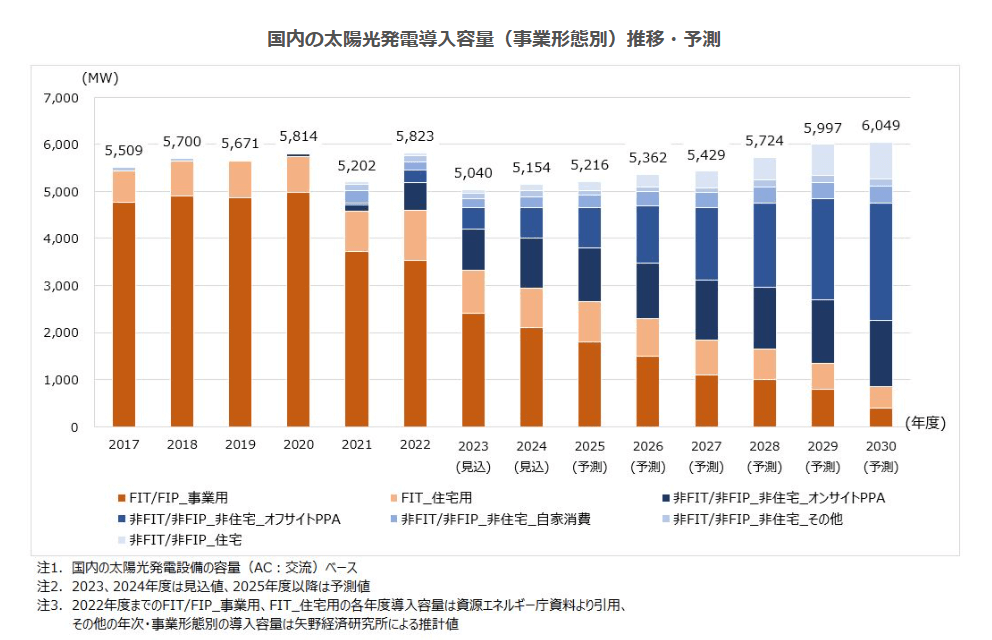

Off-site PPAs will be the most common in FY2030, followed by on-site PPAs. Solar power generation (for both residential and commercial use) using the FIT system is predicted to shrink.

Yano Research Institute Ltd. has released an analysis of the current situation and outlook for Japan's solar power generation market. This article provides an overview, quoting from the institute's release.

FIT adoption will shrink,

while PPA adoption will continue to expand

Yano Research Institute estimates that the installed capacity of solar power generation in Japan in FY2023 will be 5,040mW (AC base). This is expected to decrease significantly from the previous fiscal year due to the reduction in the installed capacity of solar power generation facilities due to the Feed-in Tariff (FIT, a fixed price purchase system for renewable energy) established in July 2012. The decrease in commercial solar power generation facilities installed under the FIT system is remarkable, and the installed capacity has been decreasing since FY2021. In particular, for the low-voltage category, the self-consumption regional utilization requirement was set in FY2020, requiring self-consumption of at least 30% of the generated electricity, resulting in a large decrease in certified capacity.

On the other hand, the introduction of PPAs, a business model that does not rely on the FIT system, is expanding. The introduction of on-site PPAs is progressing against the backdrop of the trend toward decarbonization and rising electricity prices, and it is expected that the introduction capacity of non-residential on-site PPAs in FY2023 will expand to 870mW (estimated), accounting for 17.3% of the total. In addition, as the introduction of off-site PPAs by consumers who place importance on environmental value has progressed, it is estimated that the introduction capacity of non-residential off-site PPAs in FY2023 will be 445mW (estimated), accounting for 8.8% of the total.

Consumers' desire for decarbonization is

driving the introduction of PPAs

■Let's take a look at the installed capacity of solar power generation by on-site PPA

business type. The installed capacity of on-site PPA (non-residential) has continued to expand steadily since FY2020, when full-scale introduction in Japan began, and the pace of increase is accelerating year by year. In addition to the active efforts toward decarbonization by corporate and other consumers, the recent rise in electricity prices appears to be a factor in the expansion. With on-site PPA, the PPA operator installs and owns solar power generation equipment on the rooftop or premises of the building that uses electricity, and operates and manages it. The advantage for consumers is that they do not need to pay initial costs or manage operation and maintenance of the solar power generation equipment.

■ Off-site PPA

Off-site PPAs, which have been fully implemented in Japan since around FY2022, are seeing an increase in installed capacity due to growing needs for environmental value. In an off-site PPA, the PPA operator installs, owns, and operates and manages solar power generation facilities in a location away from the base where the consumer uses electricity. Consumers can enjoy the same benefits as on-site PPAs, and PPA operators can install large-capacity solar power generation facilities without being restricted by the size of the facility, making it possible to introduce large-scale renewable energy-derived electricity over the long term. In addition to

a model in which a large-scale solar power plant is installed and electricity is supplied to consumers, there is also a model in which electricity is supplied from small-scale solar power plants, such as low-voltage solar power plants installed in separate locations.

Source: Yano Research Institute

The installed capacity in 2030

is predicted to be 6,049mW

The installed capacity of solar power generation in Japan in FY2030 is expected to be 6,049mW (AC base). It is analyzed that the installed capacity of solar power generation will gradually expand through FY2030 due to the increase in the installation of business forms that do not rely on the FIT system, such as on-site PPA and off-site PPA. In particular, the installed capacity of off-site PPA, which tends to be larger per project, is increasing at a fast pace, and is expected to exceed the installed capacity of on-site PPA in a single year in FY2026.

On the other hand, due to the continued decrease in the installed capacity of solar power generation facilities due to the FIT system, the installed capacity of solar power generation (residential and commercial) using the FIT/FIP (Feed-in Premium) system in FY2030 is expected to shrink to 850mW, 14.1% of the total.

[Keywords]

PPA (Power Purchase Agreement) refers to a mechanism in which a PPA operator establishes, owns, operates, and maintains a renewable energy power plant with its own funds, etc., and supplies the electricity generated at the plant to consumers at a long-term, fixed price. This is called a third-party ownership model because the power generation facilities are owned by a third party other than the consumer. The contract period for a PPA is often long, such as 20 years, and the consumer pays a fixed rate for electricity and environmental value during the contract period.

Invite partners to watch the activities of Pacific Group Co., Ltd.

FanPage: https://www.facebook.com/Pacific-Group

YouTube: https://www.youtube.com/@PacificGroupCoLt