Corporate PPA takes center stage! The number of companies using renewable energy procurement is increasing rapidly!

There is a growing movement to demand not only the most energy-efficient company's electric power, but also decarbonization of business partners. Procurement of renewable electricity is no longer an issue for large companies only. The corporate PPA is said to be an effective means of solving this problem. We asked Mr. Masaya Ishida of Renewable Energy Institute, who is familiar with corporate initiatives such as RE100.

Leading to the construction of new power generation facilities

Renewable energy procurement with “additionality”

In order to reduce greenhouse gas emissions, leading companies around the world are switching to electricity with the goal of 100% renewable energy. Japan is no exception, with more than 70 Japanese companies participating in the RE100, and the movement to use renewable electricity is spreading to all industries.

However, this does not mean that any renewable energy will do, and the environmental impact associated with power generation must be small and the energy source must be sustainable. Furthermore, today, there is a growing demand for procuring power from newly installed renewable energy power generation facilities, in other words, "additionality." This is because electricity procurement will directly lead to the development of new renewable energy, and will also accelerate the decarbonization of the entire country.

There are two main ways to procure power with additionality. One is to build a renewable energy power generation facility in-house and consume the power in-house. The other is a corporate PPA (Power Purchase Agreement). However, since there is a limit to the amount of power generated by in-house power generation, the mainstream is shifting to corporate PPAs.

Diverse Corporate PPAs

Features and issues of each

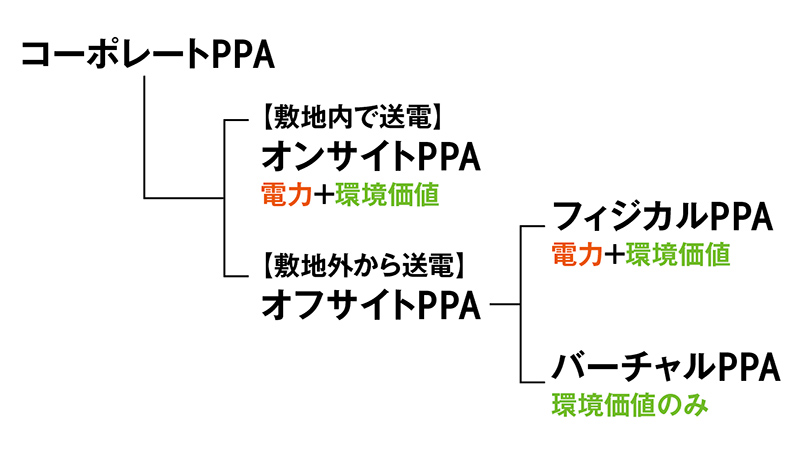

A corporate PPA is a contract under which a consumer such as a company purchases renewable power from a specific power generator over a long period of time (10 to 25 years). Corporate PPAs are divided into “onsite PPAs” and “offsite PPAs” depending on the location of the power generation facility, and offsite PPAs are further divided into “physical PPAs” and “virtual PPAs”.

Form of Corporate PPA

There are two types of offsite PPAs

Source: Renewable Energy Institute

Onsite PPA

An on-site PPA involves constructing power generation facilities in the buildings or premises (on-site) of the site where power is used (demand area), and supplying the generated power to consumers through the premises network. The construction cost will be borne by the power generation company, and the ownership of the power generation facility will belong to the power generation company.

The consumer provides the installation site for the power generation facility and pays the purchase price for the supplied power and environmental value based on a predetermined unit price. On-site PPAs are an effective means of procuring renewable energy at low cost, as long as there is space to install power generation equipment in the demand area.

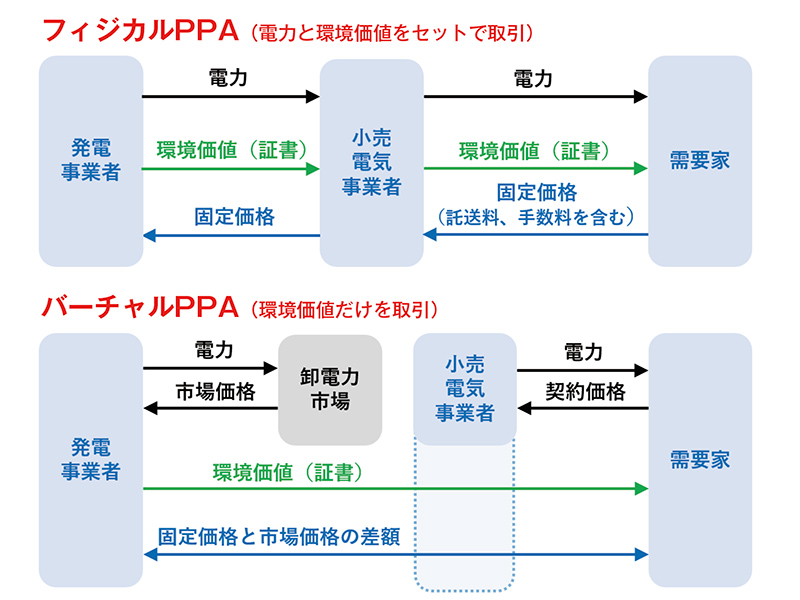

Physical PPA

An off-site PPA is when a power generation facility is constructed in a place away from the demand area (off-site). Of these, physical PPAs are contracts that cover electricity and environmental value together.

In physical PPA, electricity needs to be sent using the power transmission and distribution network, so the consumer must pay the transmission fee in addition to the purchase price of electricity and environmental value. Also, in Japan, only electricity retailers are permitted to sell electricity via the power transmission and distribution network, so they will be charged a fee. Although there are some points of lack of flexibility, such as the need to specify the bases where electricity will be used at the time of contract, it is possible to procure renewable energy stably over the long term even if there is no space to install power generation equipment in the demand area. There are benefits.

Virtual PPA

Off-site PPAs that only trade environmental value are called virtual PPAs. In a virtual PPA, only the environmental value of renewable energy power is extracted and transferred from power generators to consumers. From the consumer's point of view, electricity itself can be purchased from electricity retailers as before, and renewable electricity can be used without changing the electricity contract. In fact, a virtual PPA is not just a transaction of environmental value, but involves the construction of a new renewable energy power plant, so it is a procurement method with additionality.

Environmental value is exchanged through non-FIT non-fossil certificates, but it is up to the consumer to decide where to use the certificate. Large contracts can also be signed to add environmental value to power at multiple sites.

Although such contracts are flexible, the electricity itself is traded on the wholesale electricity market, so the income of power generators is not stable. Therefore, in the United States and other overseas countries, a system is adopted in which a fixed price is set that combines electricity and environmental value, and the "difference" between the market price and the market price is adjusted with consumers so that power generators can earn a certain amount of income. increase.

Combined with FIP

Further acceleration of introduction is possible

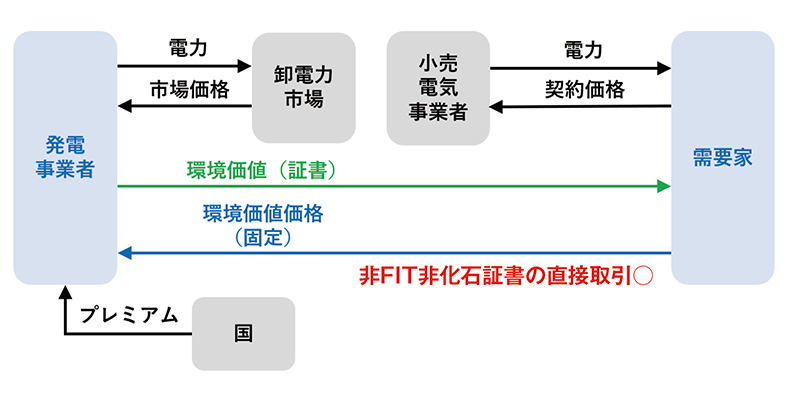

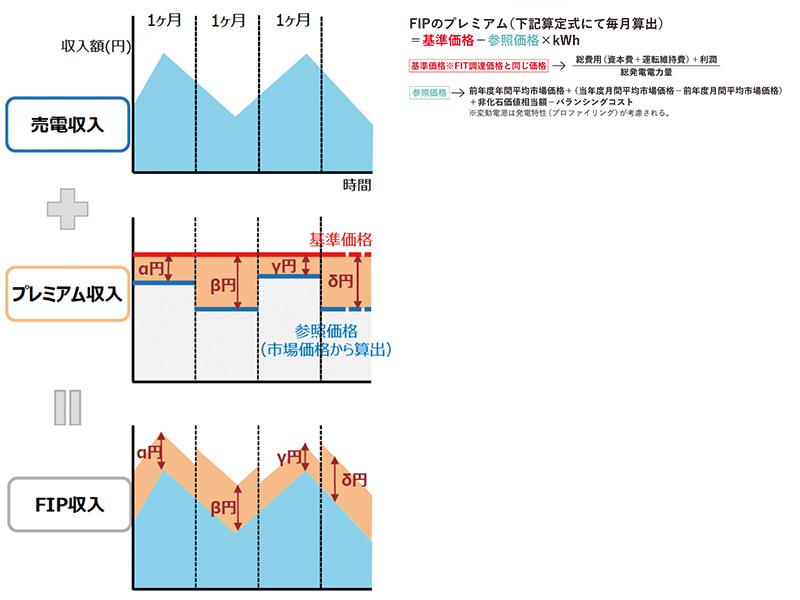

In Japan, the FIP system started this year. By combining this FIP system, it is possible to realize a virtual PPA that reduces the risk of market price fluctuations. Since the FIP premium is calculated based on the difference between the base price (fixed) and the reference price (market linked), it can be expected to fill the "difference" of the virtual PPA.

As a result, it is possible to stabilize the income of power generation companies without having to adjust the difference with the market price like in other countries. For consumers, there is no cost fluctuation risk due to price difference adjustment, so more stable renewable energy procurement is possible. Furthermore, even for power sources (wind power, small and medium-sized hydropower, geothermal power, biomass) that have higher power generation costs than solar power, the cost difference can be covered by the FIP premium.

Currently, FIP power sources are not legally subject to virtual PPAs, and direct transactions between power producers and consumers are not allowed. However, in order to add new renewable energy power generation facilities and reduce CO2 emissions of the entire power system, direct transactions of "virtual PPA + FIP" should be allowed.

Virtual PPA + FIP (direct contract) can reduce fluctuation risk

Source: Renewable Energy Institute

●FIP system income image

Source: Agency for Natural Resources and Energy

Source: Agency for Natural Resources and Energy