Từ Ngách Thành Nhu Cầu: Vì Sao CCUS Đang Chuẩn Bị Bứt Phá

Tác giả: Tatsuto Nagayasu – 16/09/2025

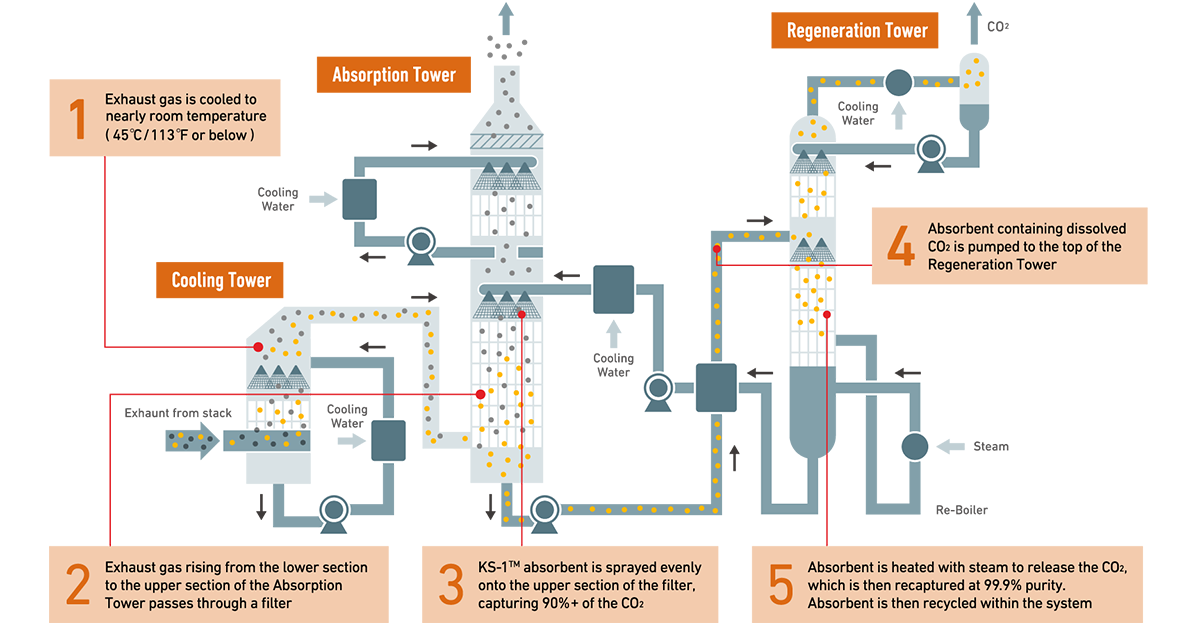

Công nghệ Thu hồi, Sử dụng và Lưu trữ Carbon (CCUS) xuất hiện từ thập niên 1970, với các dự án quy mô lớn đầu tiên được triển khai trong những năm 1990. Tuy nhiên, hơn 30 năm trôi qua, CCUS vẫn chỉ là một giải pháp “ngách”, chủ yếu phục vụ mục đích công nghiệp và thường bị lu mờ trước năng lượng tái tạo hay thậm chí là điện hạt nhân khi nói đến giảm phát thải CO₂.

Tôi tin rằng điều này sắp thay đổi. Áp lực gia tăng từ các quốc gia, ngành công nghiệp và doanh nghiệp nhằm đẩy nhanh tiến trình khử carbon – cùng với sự xuất hiện của một nhóm khách hàng mới sẵn sàng trả phí để có được nguồn năng lượng sạch và ổn định – đang tạo đà để CCUS bứt phá. Sự thay đổi này đến rất đúng thời điểm: Cơ quan Năng lượng Quốc tế (IEA) đã khẳng định CCUS là yếu tố thiết yếu để thế giới đạt mục tiêu phát thải ròng bằng 0 vào năm 2050, đặc biệt trong việc giảm phát thải cho các ngành khó khử carbon như xi măng, thép và hóa chất.

Bức Tranh Thị Trường Đang Thay Đổi

Cho đến gần đây, chỉ có các công ty công nghiệp – những đơn vị có thể tạo ra doanh thu từ lượng CO₂ thu hồi (như dùng để sản xuất urê hay methanol) – mới có thể triển khai CCUS một cách kinh tế. Gần như toàn bộ 18 nhà máy thu hồi CO₂ do Tập đoàn Mitsubishi Heavy Industries (MHI) xây dựng – nhà cung cấp dẫn đầu toàn cầu trong lĩnh vực này – đều phục vụ khách hàng trong ngành hóa dầu.

Với các đơn vị chỉ đơn thuần muốn giảm phát thải, chi phí CCUS trước đây là rào cản quá lớn. Nhưng tình hình đang thay đổi nhanh chóng. Tại Mỹ, nhu cầu điện sạch và ổn định đang bùng nổ khi các “hyperscaler” – Microsoft, Google, Amazon và nhiều gã khổng lồ công nghệ khác – gấp rút mở rộng trung tâm dữ liệu. Các doanh nghiệp này đã đặt ra các mục tiêu khí hậu nghiêm ngặt, hầu hết hướng đến mức phát thải ròng bằng 0 vào năm 2030.

Họ cần một lượng điện khổng lồ, liên tục, không được phép gián đoạn dù chỉ vài giây. Điều này khiến năng lượng tái tạo biến thiên không thể đáp ứng một mình, trong khi kết hợp với hệ thống lưu trữ pin quy mô lớn lại có chi phí rất cao trong suốt vòng đời 25–30 năm của trung tâm dữ liệu. Điện hạt nhân là một lựa chọn, nhưng cần cả thập kỷ để xây dựng. Trong bối cảnh đó, nhà máy tua-bin khí chu trình hỗn hợp (GTCC) kết hợp hệ thống CCS trở thành giải pháp khả thi nhất, vừa đáp ứng tiến độ, vừa tối ưu chi phí vòng đời.

Vai Trò Của Chính Sách Hỗ Trợ

Dù triển vọng tươi sáng, CCUS vẫn là một giải pháp đắt đỏ. Các số liệu độc lập cho thấy việc bổ sung CCS có thể làm tăng hơn 50% chi phí đầu tư của một nhà máy GTCC. Vì thế, chính sách hỗ trợ từ chính phủ là điều kiện tiên quyết – tương tự như cách các khoản trợ cấp đã giúp ngành năng lượng tái tạo mở rộng quy mô thành công.

Chính quyền Mỹ đã tái khẳng định duy trì khoản tín dụng thuế 45Q cho thu hồi CO₂ – một tín hiệu đáng mừng – trong khi đang dần cắt giảm hỗ trợ cho các công nghệ sạch khác. Tại Vương quốc Anh, chính phủ thậm chí đi xa hơn khi bảo lãnh toàn bộ quá trình khử carbon cho các cụm công nghiệp trọng điểm. Kết quả là vào tháng 12 năm ngoái, quốc gia này đã ra quyết định đầu tư cuối cùng (FID) cho một hệ thống CCS quy mô lớn tại cụm Net Zero Teesside ở đông bắc Anh. Nhật Bản cũng thúc đẩy quyết liệt khi giao cho MHI gói thiết kế FEED cho nhà máy thu hồi CO₂ lớn nhất nước tại Nhà máy điện Tomato-Atsuma của Hokkaido Electric Power, với sự hỗ trợ từ JOGMEC và kế hoạch lưu trữ CO₂ dưới tầng ngầm biển.

Từ FEED Đến FID: Thị Trường Tăng Tốc

Động lực thị trường đang tăng nhanh. Bộ phận Giải pháp GX (Chuyển đổi Xanh) của MHI hiện đang xử lý 30–40 yêu cầu từ khách hàng về CCUS, với khoảng 5 dự án ở giai đoạn FEED. Nhiều dự án trong số này dự kiến sẽ sớm bước sang giai đoạn FID và tiến tới các đơn đặt hàng chính thức.

Các cơ sở thu hồi CO₂ quy mô lớn thường cần khoảng ba năm để xây dựng. Tuy nhiên, hệ thống mô-đun như dòng CO₂MPACT™ của MHI có thể được triển khai nhanh hơn nhiều nhờ mức độ tiêu chuẩn hóa trên 90%, chế tạo sẵn và vận chuyển dưới dạng module giống như container. Nhu cầu đối với những hệ thống này đang gia tăng, đặc biệt từ các ngành muốn thử nghiệm các ứng dụng CO₂, chẳng hạn dùng để trồng cà chua, dâu tây hoặc dưa lưới.

Xây Dựng Chuỗi Giá Trị CCUS Toàn Diện

Khi thị trường CCUS mở rộng, thị phần toàn cầu 70% hiện nay của MHI chắc chắn sẽ giảm, dù doanh thu tuyệt đối tăng nhanh. MHI đặt mục tiêu duy trì vị thế dẫn đầu bằng cách liên tục cải tiến công nghệ thu hồi CO₂ dựa trên dung dịch amine – vốn được đánh giá là hiệu quả nhất hiện nay – đồng thời mở rộng danh mục sản phẩm với các giải pháp mô-đun và hệ thống thu hồi CO₂ trên tàu FPSO trong ngành dầu khí.

MHI cũng tham gia xây dựng toàn bộ chuỗi giá trị CCUS: phát triển tàu chở CO₂ hóa lỏng (Mitsubishi Shipbuilding), cung cấp máy nén khí cho khâu lưu trữ (Mitsubishi Heavy Industries Compressor Corporation) và hợp tác với các đối tác bên ngoài như ExxonMobil để đưa ra giải pháp trọn gói “end-to-end” từ thu hồi, vận chuyển, lưu trữ đến dịch vụ phát triển dự án và vận hành nhà máy.

Vai Trò Thiết Yếu Trong Khử Carbon Toàn Cầu

Những nỗ lực này đánh dấu bước chuyển mình quan trọng: CCUS không còn là giải pháp cho một nhóm nhỏ ngành công nghiệp mà đang trở thành công cụ khử carbon chủ lực. Khi thời điểm đó đến, CCUS sẽ đóng góp đáng kể vào nỗ lực toàn cầu chống biến đổi khí hậu.