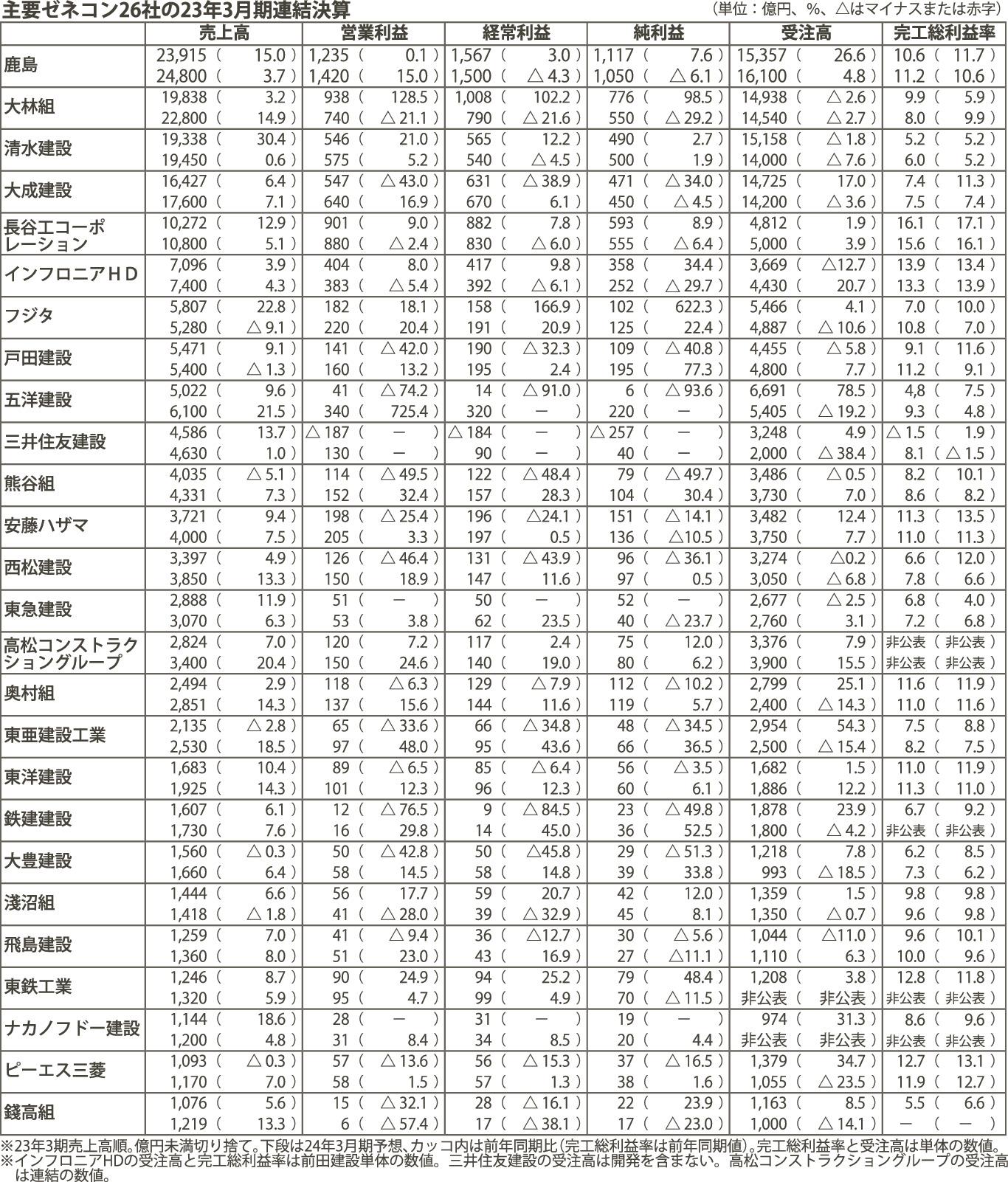

The financial results for the fiscal year ending March 2023 of 26 major general contractors were released on the 15th. Consolidated sales increased at 22 companies due to steady progress in domestic civil engineering and overseas construction. Operating profit, which shows the profit of the core business, was hit by soaring material prices, pushing down the profit level, mainly at companies with low-profit construction projects, and 14 companies fell below the previous term. In the fiscal year ending March 2012, 19 companies are expected to increase sales and profits. Each company is conscious of the construction system that can realize work style reform, and thoroughly accepts orders with an emphasis on profitability.

Twenty-two companies, including Kajima Corporation, Obayashi Corporation, Shimizu Corporation, and Taisei Corporation, recorded increased sales. Along with the progress of domestic construction, the resumption of overseas construction also contributed to recording sales. Haseko Corporation's condominium sales business performed well, and sales reached a record high of over 1 trillion yen.

Amid difficulties in securing profits, 11 companies' operating income exceeded the previous term's level, including Obayashi Corporation, which said, "In domestic construction, there was a steady increase in the amount of stocks on hand." On the other hand, there are quite a few companies (major general contractors) that "have a high ratio of low-profit projects in their on-hand work," mainly in large-scale private construction projects. Hazama Ando is heard from companies whose profits have declined, saying, "We have no choice but to make steady efforts such as accelerating contracts." There is also a sense of wariness that material prices will rise further, and some companies are working on contract negotiations in response to price fluctuations.

The gross profit margin (gross profit) on completed construction contracts on a parent basis, which indicates the profitability of construction work, was also lower than in the previous term. Only eight companies, including Inphronia Holdings (HD), cited "thorough management of the profit margin at the time of receiving an order" as the reason for securing a double-digit figure.

Non-consolidated orders received, which is a leading indicator of performance, increased from the previous term for 18 companies against the backdrop of abundant construction demand and the recovery of the domestic economy. Of the 24 companies that have announced earnings forecasts for the fiscal year ending March 2012, 14 expect a decrease in orders. In anticipation of the application of the upper limit on overtime work from April 2014, multiple general contractors will be able to assess future orders in order to maintain their construction systems. While promoting measures to improve productivity such as DX, most companies will bid on the premise that the facility will be closed eight times a week and work on negotiations to secure an appropriate construction period.